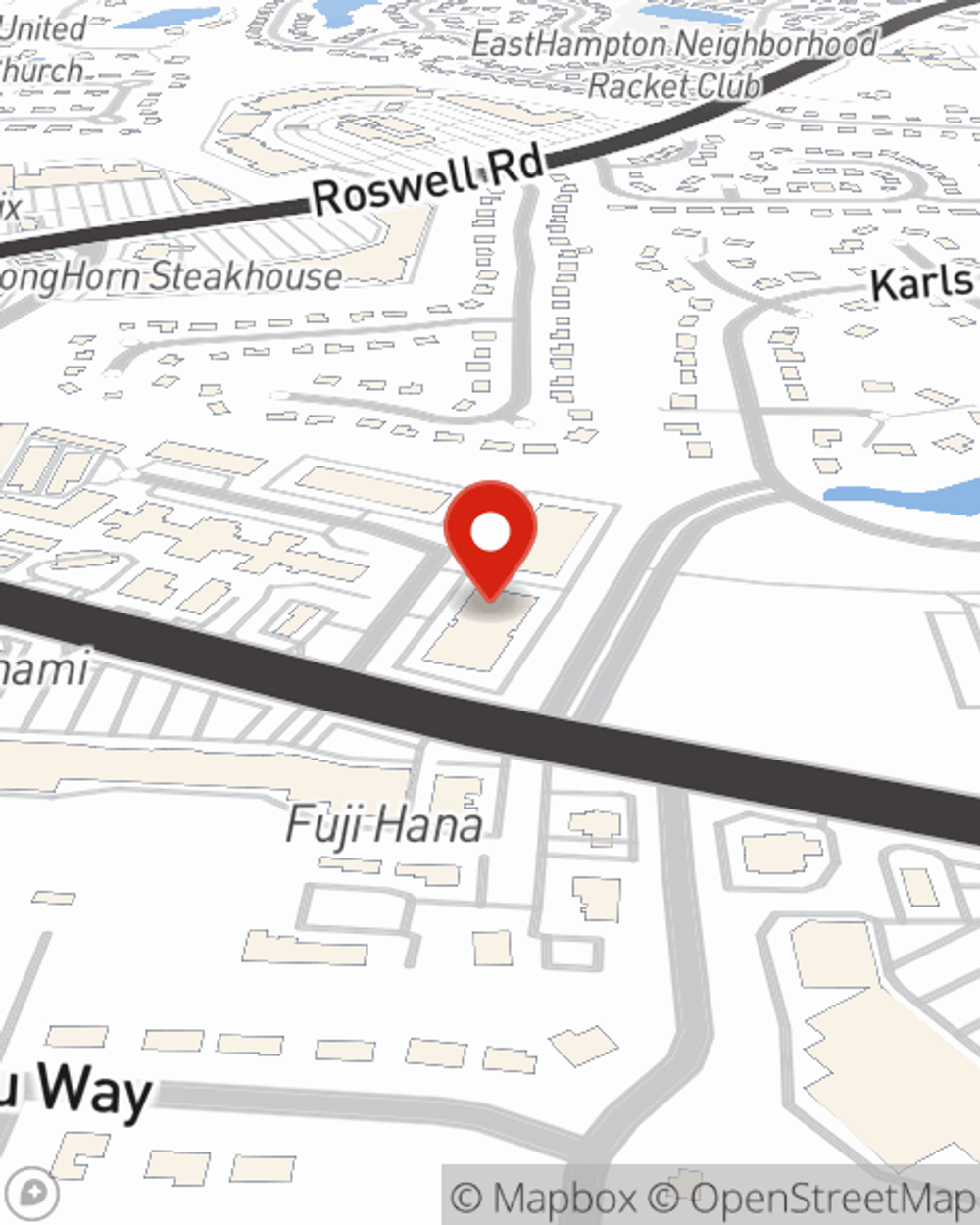

Life Insurance in and around Marietta

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Marietta

- Kennesaw

- Acworth

- Woodstock

- Smyrna

- Roswell

- Atlanta

- Canton

- Sandy Springs

- Mableton

- Alpharetta

- Holly Springs

- Cartersville

- Austell

- Hiram

- Dallas

- Powder Springs

- Brookhaven

- Decatur

Your Life Insurance Search Is Over

If you are young and newly married, it's the perfect time to talk with State Farm Agent Lauren Porter about life insurance. That's because once you buy a home or condo, you'll want to be ready if tragedy strikes.

Protection for those you care about

Don't delay your search for Life insurance

Wondering If You're Too Young For Life Insurance?

Life can be just as unpredictable when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific time frame or coverage for a specific number of years, State Farm can help you choose the right policy for you.

As a dependable provider of life insurance in Marietta, GA, State Farm is committed to be there for you and your loved ones. Call State Farm agent Lauren Porter today and see how you can save.

Have More Questions About Life Insurance?

Call Lauren at (678) 373-0030 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Lauren Porter

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.